how much taxes are taken out of a paycheck in ky

Total income taxes paid. Complete and file a Form 2040.

2d Animator Artist Salary In Lexington Ky Comparably

Ashland 1539 Greenup Avenue 41101-7695 606 920-2037 Fax.

. Regardless of their filing status Kentuckians are taxed at a flat rate of 5. You also have to pay local income taxes which Kentucky calls. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS. The state previously had progressive tax rates ranging from 2 to 6 but changed to a flat rate system during a tax reform in early 2018. Amount taken out of an average biweekly paycheck.

How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. Both employers and employees are responsible for payroll taxes.

Overview of Kentucky Taxes. Take Home Pay for 2022. 606 920-2039 Bowling Green 201 West Professional Park Court 42104-3278 270 746-7470.

This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis. However they dont include all taxes related to payroll. The calculation is based on the 2022 tax brackets and the new W-4 which in.

At the same time cities and counties may impose their own occupational taxes directly on wages bringing the total tax rates in some areas to up to 750. Speak with a KPPA counselor on the phone. Your average tax rate is 222 and your marginal tax rate is 361.

The state of Kentucky uses a graduated income tax schedule much the same way the federal government does. We depend on word of mouth to help us grow and keep the US Tax Calculator free to use. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Contact our office toll free at 1-800-928-4646 or locally at 502-696-8800. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. These amounts are paid by both employees and employers.

For instance workers who make 3000 a year or less in taxable income pay state taxes at a rate of 2 percent while those who earn between. Posted by 5 years ago. The Medicare tax rate is 145.

Kentucky Hourly Paycheck Calculator. Kentucky has a flat income tax of 5. Workers at the lowest end of the economic scale pay a lesser percentage of their income in taxes than those who earn more.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. That rate ranks slightly below the national average. This calculator is intended for use by US.

It depends as the IRS uses one of two methods. It can also be used to help fill steps 3 and 4 of a W-4 form. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Amount taken out of an average biweekly paycheck. FICA taxes are commonly called the payroll tax. Employers also have to pay a matching 62 tax up to the wage limit.

Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the year. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. FICA taxes consist of Social Security and Medicare taxes.

Log in to Self Service. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. For instance an increase of 100 in your salary will be taxed 3613 hence your net.

The average taxpayer gets a tax refund of about 2800 every year. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Complete a Form 2040 Change of Address Notification and file it with KPPA. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. What Do Small Business.

This Kentucky bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. This marginal tax rate means that your immediate additional income will be taxed at this rate. This is because they have too much tax withheld from their paychecks.

We hope you found this salary example useful and now feel your can work out taxes on 38k salary if you did it would be great if you could share it and let others know about iCalculator. You can easily update your address on our Self Service website. A 2020 or later W4 is required for all new employees.

Breaking Down Paystub Deduction Codes Paystubcreator

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

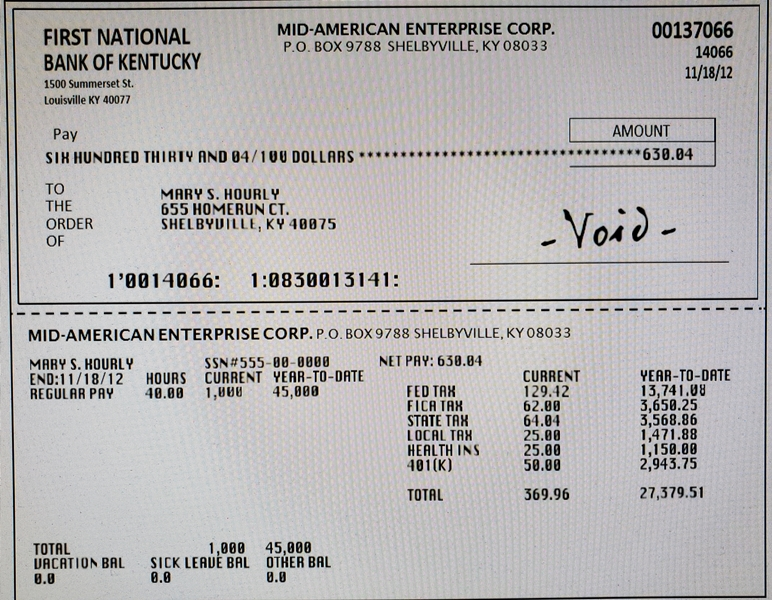

Solved Look At The Check Below And Answer The Following Chegg Com

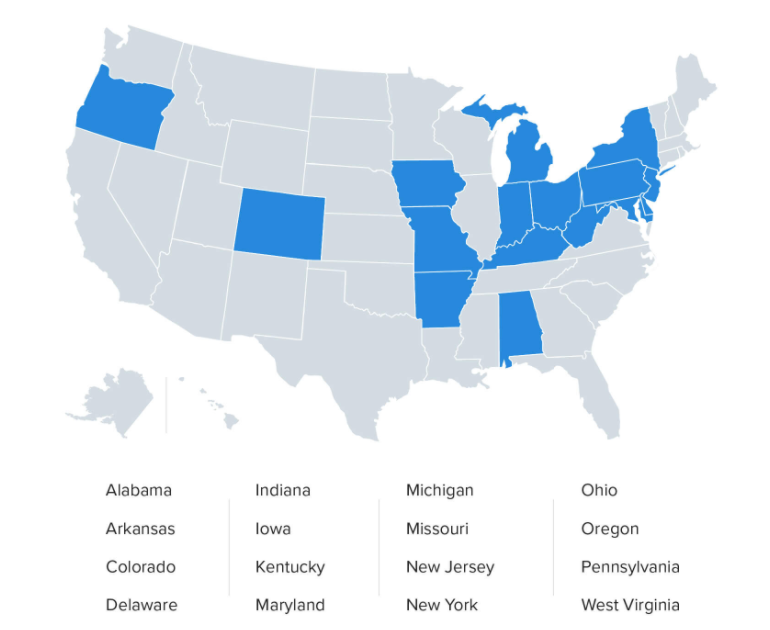

The Us States That Take The Most From Your Paycheck Business Insider India

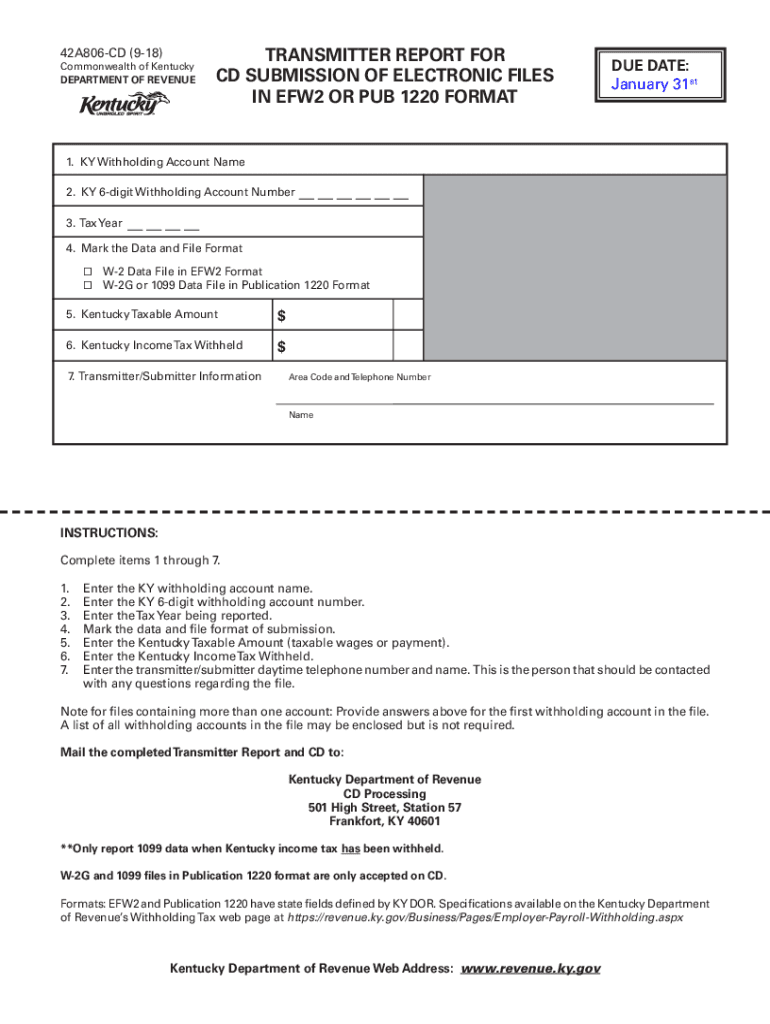

Ky Dor 42a806 2018 2022 Fill Out Tax Template Online Us Legal Forms

Ezpaycheck 2018 Software From Halfpricesoft Com Updated To Reflect Ky Tax Rate Changes

Peoplesoft Payroll For North America 9 1 Peoplebook

Paycheck Calculator Kentucky Ky Hourly Salary

Salary Paycheck Calculator Calculate Net Income Adp

Payroll Software Solution For Kentucky Small Business

2022 Federal State Payroll Tax Rates For Employers

Does Payroll Fall Under Hr Or Accounts Payable

I Got 36 Of Taxes Taken Away From A 340 Paycheck Does That Sound Right Quora

Tax Withholding For Pensions And Social Security Sensible Money

Kentucky Paycheck Calculator Smartasset

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Free Online Paycheck Calculator Calculate Take Home Pay 2022